Neighbor Works Montana - an Opportunity to Finance

At HōM 406 we believe homeownership is a privilege that should be extended to as many potential homeowners as is possible. Creative and aggressive lending programs often hold the key to alternative housing solutions. If you are prepared to do the work, there are lenders that are prepared to bet on you!

I recently received a letter from the Executive Director of Neighbor Works Montana (NWMT) that I wanted to share with you. It is a introduction to alternative lending avenues that are available in today's competitive lending market and may hold a few ideas for you, your friends or a family member.

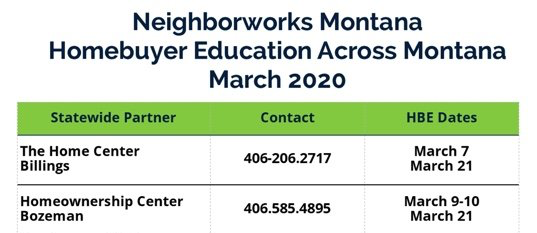

Everyone deserves a leg up in our competitive Bozeman market! Who do you know that could benefit from a supplemented loan program? Note, I've included an image to reference the upcoming Bozeman Homeownership Class offered by NWMT - March 9-10. This could be a great asset to position a new buyer with the tools to cultivate success in homeownership!

At the bottom of the letter, Kaia asks for feedback to help identify gaps in our lending community. I would love to pass your thoughts along. Where do you think Bozeman could do better in providing tools to homebuyers? And secondly, what assets are we under leveraging in our community?

A LETTER FROM EXECUTIVE DIRECTOR,

KAIA PETERSON

Hello NWMT Lending Partners,

As the new Executive Director, I wanted to take a moment to introduce myself to you. I have had the pleasure of getting to know many of you through my work with the organization over the past seven years, and I look forward to getting to know and work with many more of you in my new role. I have been with NWMT for seven years, the past three as Assistant Director, and prior to that as the manager of our Housing Education and Counseling Program and our Resident Owned Communities Program.

Lending is one of the most important aspects of our work at NWMT, increasing access to capital for low- and moderate-income households and communities. My passion for the power of creating opportunity through finance started by getting my MBA at the University of Washington and then moving to Montana where I first worked in small business community development for five years as a loan officer and then risk and portfolio manager. Community Development Financial Institutions (CDFIs) like NWMT look for opportunities to meet the needs of people and places that are just outside of bankability, and provide a combination of appropriate financing, education and support that helps them succeed.

I find this to be an incredibly powerful model that builds on existing community assets and leverages private sector dollars to the benefit of people and places who may not otherwise have access to these resources. We use our finance brains and our community focused hearts to say yes where others have said no, and we help clients succeed not only in securing a loan but in successfully paying off those loans as they gain more financial security. I know you as lenders relate to the power of helping clients realize their dreams and the joy of getting to be a small but critical part of their success.

Here are a few of the things we at NWMT do with our financing:

- Give clients a chance to prove new types of development like Homeword’s Montana Street Homes.

- Help meet the growing need for rental homes that are affordable to our lowest-income residents through projects like Rockcress Commons in Great Falls.

- Welcome new buyers to homeownership through down payment assistance that helps them build stronger futures for themselves and their families in communities as small as Kinsey and as large as Billings.

- Work side by side with residents of manufactured home communities as they gain the stability and opportunity that comes with owning their own land, like the residents of View Vista Community in Livingston

who became the newest Resident Owned Community just last month.

NWMT’s loan fund has grown substantially over the past ten years, from $3 million in 2009 to $25 million at the end of 2019. While this is a small fund in comparison to assets held by traditional lending institutions, the power of these dollars is that they leverage other financing sources and allow them to reach people and places they otherwise could not serve.

You and your lending institutions are essential partners in this work, and we are so grateful for your work with us and in the communities you serve. As we build new programs and products, we will be looking to you for insights and collaboration. What are the gaps and needs in your communities that you think different financing could help meet? What are the assets and strengths in your communities that you think need a chance to be leveraged?

Do you have an idea? Give me a call, send me an email, get in touch. NWMT staff and I will be asking these questions as we are out in Montana communities, and we look forward to working together to give every Montanan the opportunity to live in a home where they can thrive.

In partnership and with gratitude,

Kaia Peterson

Executive Director

kpeterson@nwmt.org

406.604.4543