HōM 406

LIVE BOZEMAN STYLE

News

Understanding Property Taxes: Why Mill Levies are Your Friend!

This is a subtitle for your new post

Understanding Property Tax Appraisals

By now, you’ve received your Montana Department of Revenue Property Classification and Appraisal notice, and I’d estimate you are, at the very least, irritated with the new taxable value. That irritation can be offset when you remember, as a homeowner, you are statistically 44X wealthier than you would be as a non-homeowner, and both parties are suffering the hit of new taxable values.

Gallatin County homeowners saw home values increase anywhere from 40-70% in this reassessment cycle.

Personally, my bill increased by 53% over the last assessment. This taxable value change will significantly impact your tax bill over the years; it is not, however, immediate.

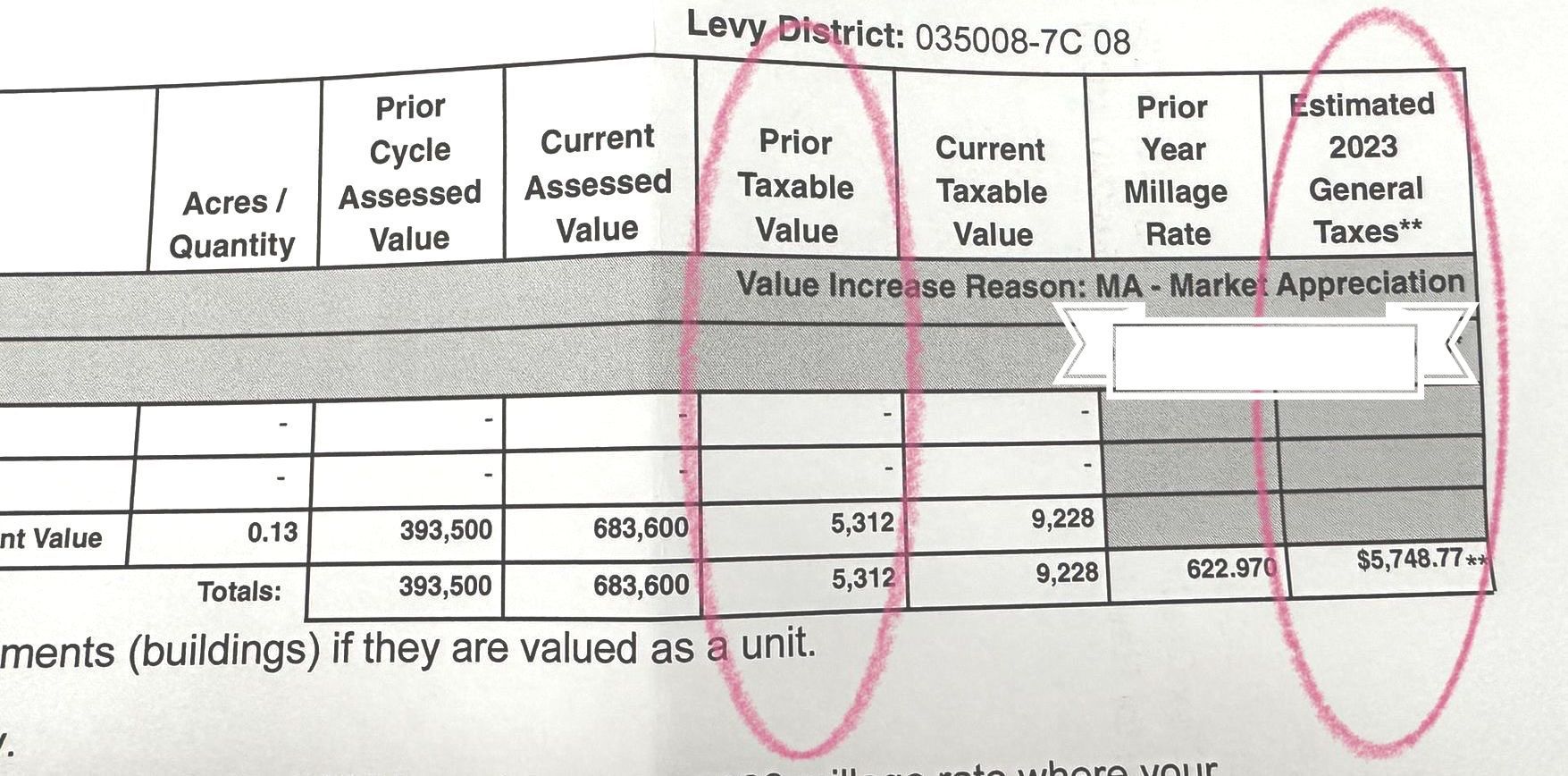

I've included a sample tax bill below, note the Prior Taxable Value and the Estimated 2023 taxes. Even though the property increased on the "Current Taxable Value" notably, Mill Levy limits protect homeowners from significant tax hikes on real property in Montana.

Understanding Mill Levey Limits: Montana Department of Revenue

Levy limits cap revenue growth, usually by limiting growth to a certain percentage or linking the growth to inflation. With a levy limit, total revenue is limited, but the impact on individual taxpayers varies based on a property’s assessed value. Adjustments to mill levies and assessment ratios under a levy limit may also have disparate effects. Thirty-six states have levy limits.

Montana has a levy limit provided for in section 15-10-420, MCA. The levy limit holds the mill levy to “a mill levy sufficient to generate the amount of property taxes actually assessed in the prior year plus one-half of the average rate of inflation for the prior 3 years.” [1]

Breaking down the legalese: While my taxable value increased by 53%, my actual tax bill is increasing ONLY (she says sarcastically) 8%. It will take years of small increases and continued inflation rates to bring my tax bill for my property in alignment with the revamped “taxable value.”

A benefit for Montanan’s:

Mill levies, rate levies, and assessment limits in Montana are tied to the property & inflation limits. Tying the rate to the property and market trends, instead of the individual owner allows Montanans to freely buy and sell the property as it suits their life without binding the owner to their current property because they are enjoying a depressed, irreplaceable tax rate.

Notes on our Assessment Schedule:

The tax bill is reassessed bi-annually for properties with structures and every six (6) years for forest land.

[1] leg.MT.gov

Key Takeaways:

This is a hard topic.

I'd happily sit down and have a coffee with you and discuss what I understand about the impact of our new taxable values and the protection of mill limits. The biggest takeaway for me, when I researched protesting the new taxable value, was that unless your property had incorrect information (i.e., ten garages instead of one... that happened to a client), then protesting is probably ineffective.

The second big element is that although your taxes have been re-assessed, you aren't immediately going to be responsible for the new "taxable value." Breathe deep, it will take years of inflation, and no market adjustments to reach these new values.