The Power of an Interest Rate Buy Down: Setting Your Property Apart

As interest rates increase to correct market inflation, Sellers and Buyers are looking to their REALTORS® for creative solutions to help keep their real estate sales and new property purchases moving forward.

Life changes and shifting markets don’t prevent homeowners from accepting new jobs, changing communities, or embarking on new adventures! Fluidity to facilitate these changes in the real estate market is cultivated through agent advocacy for our clients and solution finding by your REALTOR®!

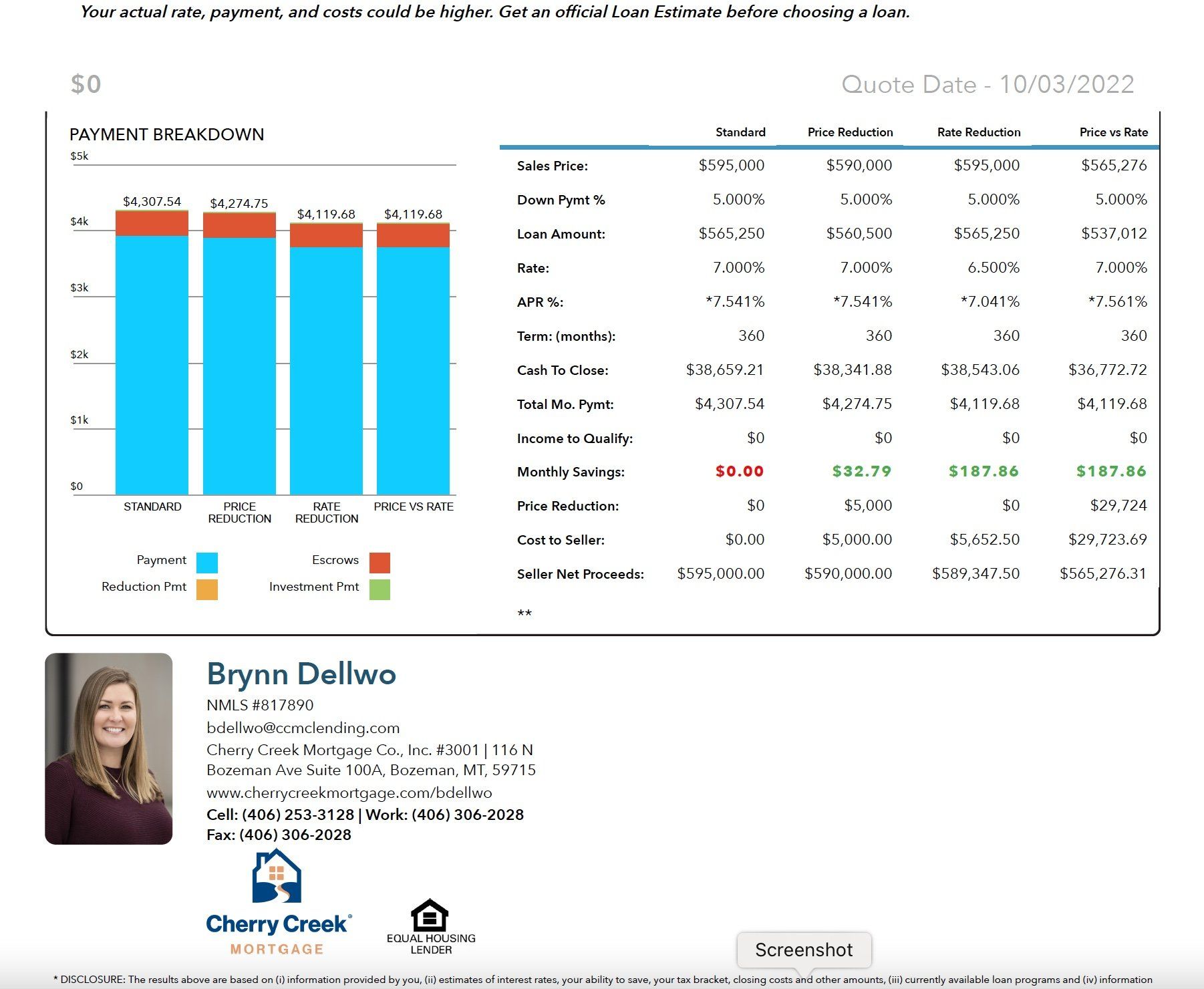

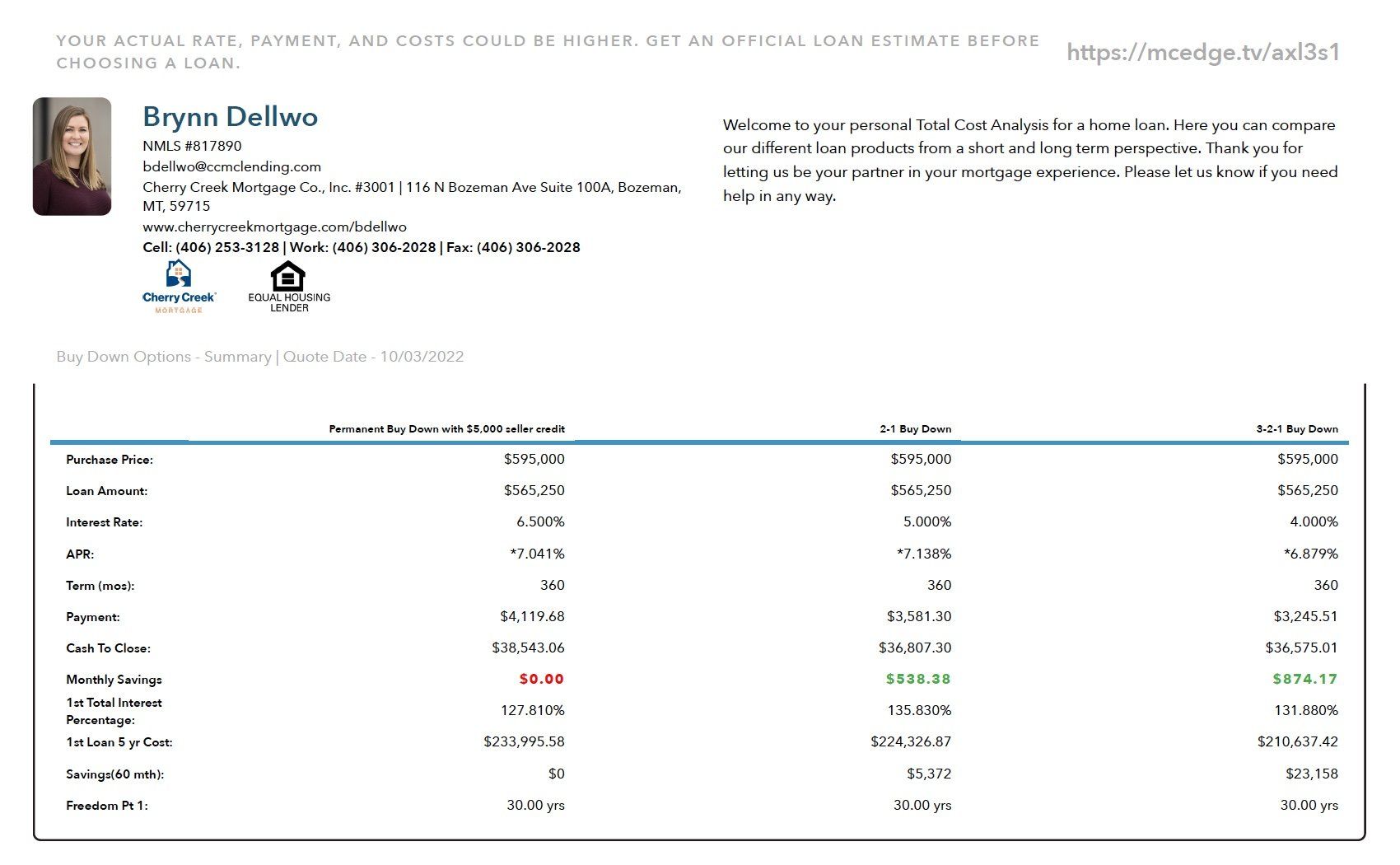

Interest rate buy downs are a compelling negotiation tool for both Sellers and Buyers and should be a consideration in every negotiation today.

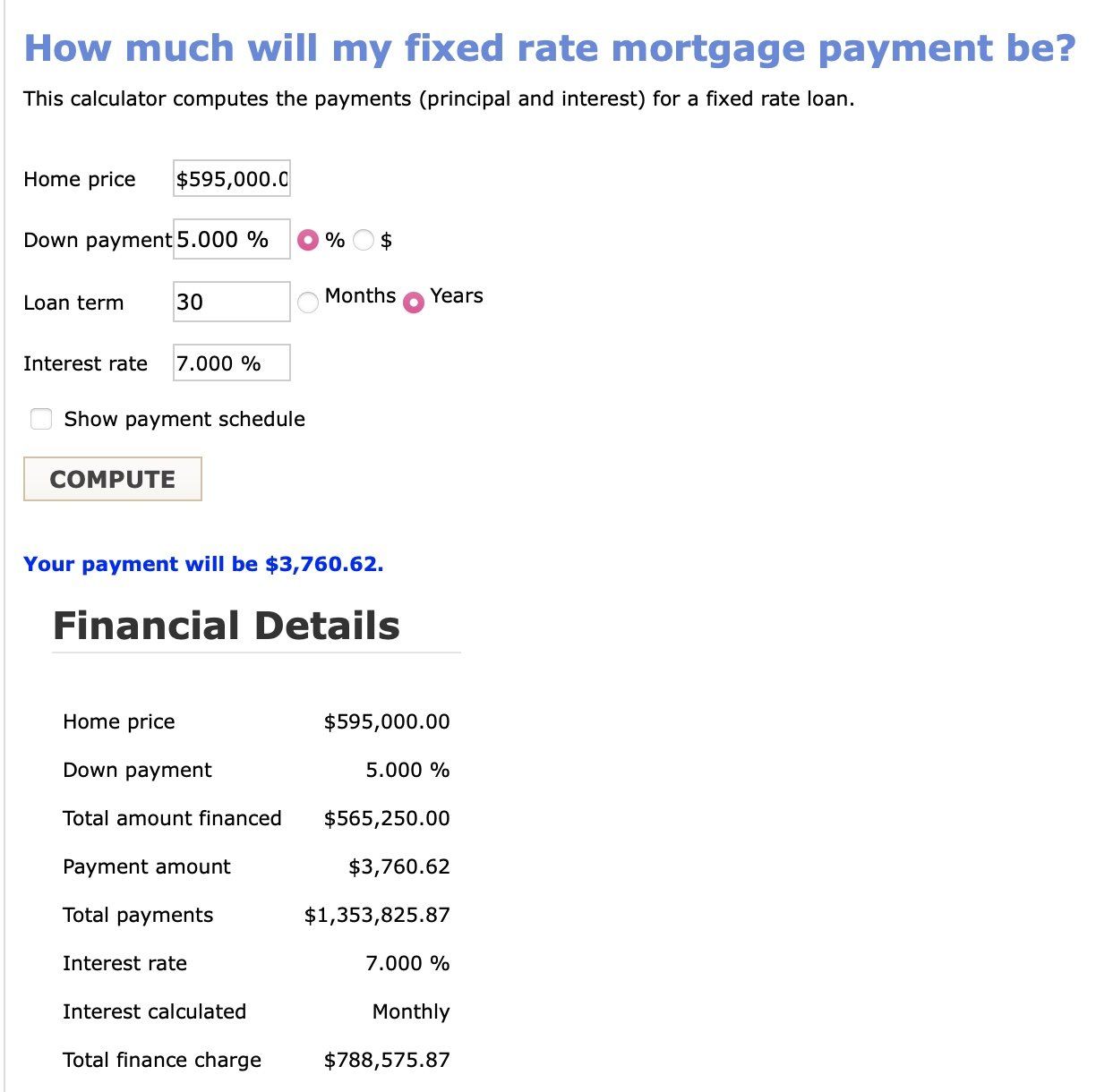

With 100-point rate index increases happening frequently, buying power for Buyers with financing is ever changing. A Buyer qualified in April of 2022 to purchase a property with an asking price up to $900,000 when interest rates were in the 4% range, may now be facing a $600,000 maximum qualification due to the increasing interest rates current 7% on a 30 year fixed mortgage for a well-qualified Buyer. This significant buying power change has happened quickly, and Sellers and their agents should assess the position of their listing in the market weekly to ensure the current asking price reflects the Buyer’s rapidly changing buying power.